Between national acquisitions, allied rotations, and new Russian provocations, Estonia, Latvia, and Lithuania are accelerating the construction of an integrated air-defense posture.

Strategic context: rising pressure

Since early 2025, aerial threats in the Baltic Sea region have intensified. Unidentified drones have probed sensitive areas, and direct violations of Baltic airspace have occurred. In mid-September, three Russian MiG-31 interceptors entered Estonian airspace for 12 minutes, prompting an Italian F-35 scramble and an Estonian request for an Article 4 NATO consultation.

These incidents followed drone sightings near Danish military facilities, as well as tensions over Poland and Lithuania.

NATO responded by launching Baltic Sentry, deploying an air-defense frigate and ISR assets, while reinforcing the Eastern Sentry operation on the eastern flank.

Most significantly, the Alliance adopted new ROE: national forces now have more autonomy to respond immediately to incursions and drone threats without waiting for collective approval.

Taken together, these steps signal a turning point: the Baltics are no longer just vulnerable buffer zones, but active testbeds of NATO credibility.

Estonia: from VSHORAD to MRAD, sensors enhanced

Tallinn has already fielded the Mistral 3 Very-Short-Range Air Defense (VSHORAD) system from MBDA, a €200 million investment to cover the lowest tier.

Alongside Riga, Estonia selected the IRIS-T SLM (Infra Red Imaging System Tail/Surface Launched Medium range) in 2023, with deliveries expected between 2025 and 2026. On the sensor side, Estonia is acquiring two Thales Ground Master 400 Alpha (GM400α) radars to improve low-altitude detection and NATO integration.

On the industrial front, Estonia and Latvia have joined the European “drone wall” initiative: Defsecintel and Origin Robotics are pairing the mobile Eirshield counter-UAS system with interceptor drones called “Blaze.”

Bottom line: Estonia is building a credible layered foundation — Mistral 3 + IRIS-T SLM — supported by modern radars and innovative counter-drone systems.

Latvia: MRAD procurement, strategic radars, allied support

In 2023, Riga signed for the IRIS-T SLM medium-range air defense (MRAD), its largest defense investment since independence.

Latvia also hosts allied NASAMS (Norwegian Advanced Surface-to-Air Missile System) deployments under NATO frameworks.

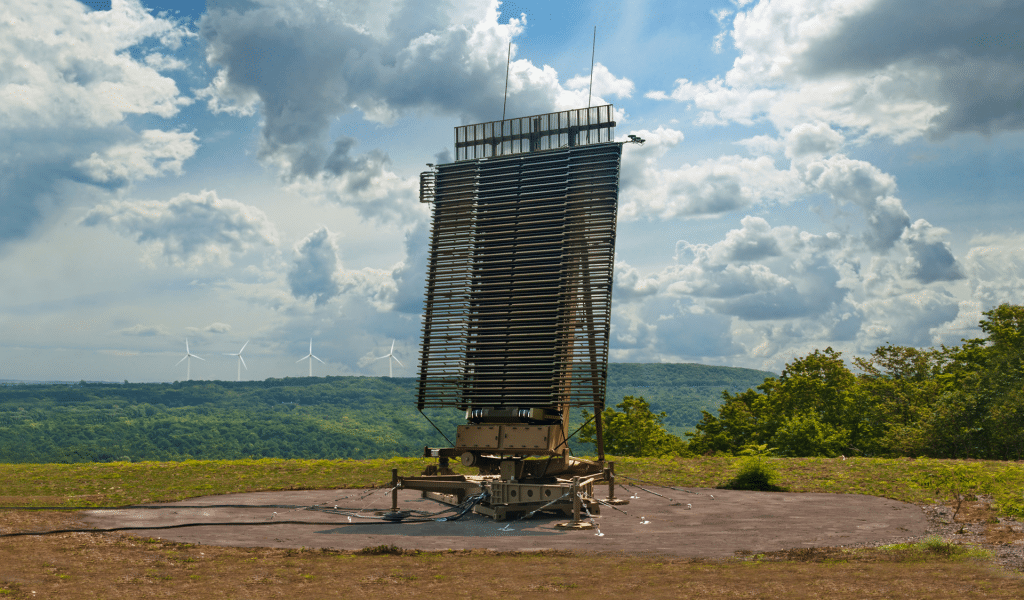

Surveillance relies on a fleet of TPS-77 long-range air-surveillance radars from Lockheed Martin, forming the backbone of the BALTNET (Baltic Air Surveillance Network).

Following the Estonian airspace violations, Riga publicly urged NATO to reinforce Baltic defenses and accelerate deliveries. Meanwhile, Rheinmetall announced a €275 million ammunition plant in Latvia, strengthening the country’s defense industry and logistics base.

Bottom line: Latvia is anchoring NATO’s air-defense posture with its IRIS-T buy and TPS-77 radar coverage.

Lithuania: expanding NASAMS, investing with realism

Lithuania has operated NASAMS since 2020 and signed additional contracts (~€193 million) to expand coverage.

It has also ordered Saab’s MSHORAD (Mobile Short-Range Air Defense) / RBS 70 NG (New Generation), with deliveries running from 2025 to 2029 to counter low-altitude drones. Vilnius regularly hosts Patriot (Phased Array Tracking Radar to Intercept of Target) batteries from allied forces, providing periodic long-range coverage.

In September, the government announced a €500 million air-defense investment plan. Yet the Lithuanian defense chief stressed that full national coverage remains unattainable: priority will focus on border zones and strategic infrastructure.

Bottom line: Lithuania is assembling a credible mix — NASAMS + MSHORAD — bolstered by Patriot rotations, underpinned by a realistic acknowledgment of resource limits.

NATO: integration, doctrine, and new sensors

Baltic Air Policing (BAP) remains the Alliance’s visible frontline, with rotating F-35, Eurofighter, and F-16 detachments at Šiauliai and Ämari. NATO is strengthening radar integration into IAMD (Integrated Air and Missile Defense), focusing on low-altitude detection against drones and cruise missiles. The new ROE mark a doctrinal shift toward faster national responses.

At the same time, the U.S. Army is preparing to deploy acoustic sensors in the region, modeled on Ukrainian networks, to detect low-signature drones.

What it means for the Baltic shield

- Faster response: shortening sensor-to-shooter timelines against incursions and drones.

- Layered resilience: combining MRAD (IRIS-T, NASAMS), VSHORAD (Mistral 3, RBS 70 NG), and allied Patriot reinforcements.

- Sensors as lifelines: GM400α, TPS-77, and acoustic grids are critical for early warning.

- Allied plug-ins: Baltic Sentry and Eastern Sentry are moving from symbolic to operational.

- Realism matters: as Vilnius acknowledged, total coverage is impossible, resources must be focused on high-risk zones.

The September 2025 incidents — MiG-31s over Estonia, drones near Denmark, NATO’s ROE shift — have accelerated the trajectory of Baltic air defense. The region is no longer a passive frontline but a doctrinal laboratory testing sensor fusion, decision-making speed and the cohesion of collective deterrence.

The shield is not perfect — but it is growing stronger, and it now sits at the heart of NATO’s credibility.