Turkey’s defense industry is hitting export records in 2025, powered by drones, the KAAN fighter program, and broader diversification across Europe and Asia. Bayraktar drones, the KAAN fighter, armored vehicles in Europe, and rising exports: Turkey is establishing itself as a major defense actor, despite persistent technological and geopolitical challenges.

A confirmed upward trajectory

Turkey’s defense industry continues to climb. In 2024, exports reached about $7.1–7.2 billion, a record high reported by national authorities and trade bodies. In 2025, momentum holds: ≈ $3.6 billion in the first half, a rough 20–30% increase depending on the baseline. At IDEF 2025, Ankara announced nearly $9 billion in agreements (MoUs/LoIs/contracts), figures to be consolidated later. Internationally, Turkey ranks among the top 15 arms exporters; it placed 11th over 2020–2024 per SIPRI.

This trajectory rests on a pragmatic model: competitive costs, short development cycles, and an “ITAR-lite” posture less exposed to U.S. export restrictions, paired with growing reliance on domestic sensors and subsystems.

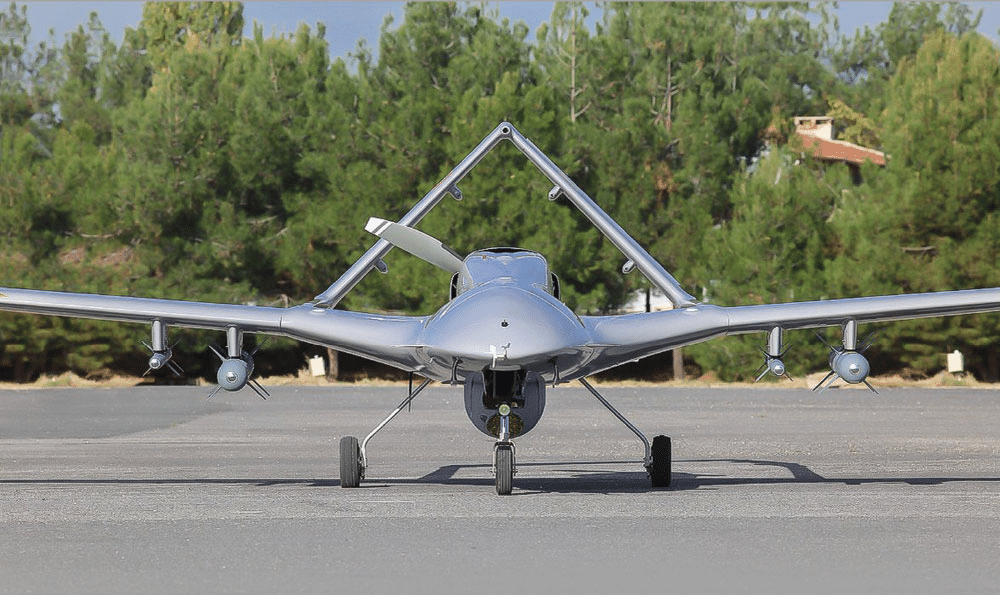

Drones: the global showcase

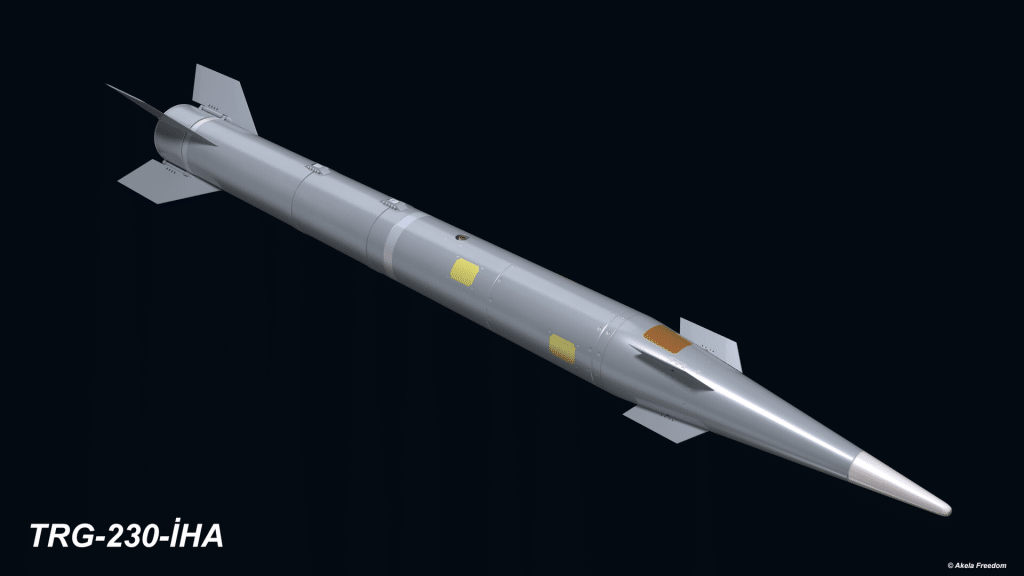

Bayraktar TB2 and Akıncı remain Turkey’s export spearhead, adopted by more than 30 countries across Africa, the Middle East, Asia, and Eastern Europe, buoyed by a strong combat-proven reputation (Libya, Nagorno-Karabakh, Ukraine). The MALE + precision-munition pairing (MAM, TRG-230/300 and derivatives) demonstrates the convergence of ISR, strike, and endurance. Following the Canadian embargo, replacing foreign payloads with ASELSAN CATS optronics strengthened technological sovereignty and reduced supply-chain risk. The TRG-230-İHA / UAV-230 integrated on Akıncı underscores growing drone-missile integration, validated by long-range firing demonstrations.

Aerospace ambition: the KAAN bet

The late-July 2025 announcement of 48 KAAN fighters for Indonesia would mark a major milestone: Turkey’s first export of a putative “fifth-generation” fighter, with technology transfer and a ramped production schedule into the 2030s. That breakthrough remains conditional on two choke points:

- Export licensing blocks on GE F110 engines in the U.S., and

- Maturity of the domestic TF-6000 / TF-10000 alternatives, which are still progressing. KAAN’s success hinges on resolving the engine risk and TAI’s ability to industrialize the platform.

In parallel, the HÜRJET (trainer/light-attack) and the T129 ATAK helicopter consolidate Turkey’s footprint in the mid-tier aerospace market.

To bridge near-term gaps, the United Kingdom finalized on October 27, 2025 an agreement for 20 Eurofighter Typhoons for Turkey (follow-on tranches remain possible).

Armor, missiles and air defense: a broadening portfolio

On land, Turkey is gaining ground in Europe. The Otokar–Romania COBRA II contract calls for local production from 2025, while FNSS, BMC, and Katmerciler sustain a strong presence in Africa and the Middle East. The industrial bet: customizable, cost-effective vehicles that compete well on cost-to-capability.

On the munitions side, Roketsan fields a comprehensive portfolio:

- TRG-230/300 guided rockets,

- OMTAS / L-UMTAS anti-tank missiles,

- SUNGUR MANPADS,

- Layered air defense with HİSAR-O / SİPER.

The TRG-230-İHA integrated on Akıncı epitomizes Turkey’s integrated strike approach, connecting sensors, shooters, and effects.

Naval: from corvette to power projection

MILGEM remains Turkey’s maritime flagship program. Babur-class corvettes for Pakistan continue deliveries.

For Ukraine, two hulls have been launched (2022 and August 1, 2024), and the first has entered sea trials; commissioning depends on trials, fit-out, and the operational context. In Nigeria, two OPV-76 vessels from Dearsan were launched (2023/2024) and completed sea trials in 2025; deliveries were scheduled for 2025, with official handover pending confirmation by the Nigerian Navy.

In parallel, Turkey began construction in January 2025 of its first domestically built aircraft carrier (the MUGEM class), a strategic milestone for expeditionary capabilities.

Diverse markets, flexible playbook

Africa, the Middle East, and the Asia-Pacific remain Turkey’s main growth zones. A flexible regulatory posture, paired with co-production and technology-transfer offers, appeals to states seeking to sidestep ITAR constraints. In Europe, Ankara favors a collaborative approach via joint projects and local footprints (Romania, Hungary, Poland).

The strategy provides a credible alternative to traditional suppliers while deepening Turkey’s industrial autonomy.

Risks and vulnerabilities to watch

Despite success, several weaknesses remain:

- KAAN propulsion is not yet resolved;

- Supply chains remain under strain despite substitution efforts;

- Political risks (sanctions, end-use clauses, diplomatic pressure) can jeopardize deals;

- U.S. and Chinese competitors are intensifying pressure in missiles and electronics.

- Turkey also needs to strengthen logistics support and after-sales, a frequent concern among African and Asian customers.

Outlook to 2030: industrialization and credibility

The next five years will be decisive.

- KAAN could become Turkey’s showcase if it enters serial production.

- Armed drones should sustain a regional lead.

- HİSAR/SİPER air-defense systems could offer a credible alternative to Patriot or SAMP/T.

- In naval, OPVs and modular corvettes aim for a durable foothold in African and Asian markets.

The central challenge is unchanged: turn announcements into deliveries, and deliveries into lasting influence.

Between industrial ambition and a credibility test

Turkey’s defense industry is in an unprecedented expansion phase.

Built on speed of execution, cost control, and growing self-reliance, it positions itself as an intermediate offering between Western standards and Chinese proposals. Its future depends on meeting technical promises, stabilizing partnerships, and avoiding political pitfalls that could slow its ascent.